Your Money Back To You

Capital Credits are a return of money you paid for electricity in previous years. As a member-owner of a cooperative, you have a share in the earnings. Rates are set to bring in enough money to pay operating costs, make payments on loans, and provide an emergency reserve. When revenues exceed the expense of providing service it is considered margins and returned to you in the form of "Capital Credits".

The margins represent a contribution of operating capital by the membership to the cooperative with the intent the capital will be retired (repaid) to you in later years when the board of trustees determine the financial conditions are such to retire capital credits.

Capital Credits Explained

A member owned cooperative does not technically earn profits. Any revenues over and above the cost of doing business are considered margins.

These margins represent an interest-free loan of operating capital by the membership to the cooperative. This capital allows Lane-Scott Electric to finance operations and, to a certain extent, construction, with the intent that this capital will be repaid to you in later years.

1. Your cooperative tracks how much electricity you purchase and how much money you pay for it throughout the year.

2. At the end of the year, your cooperative completes a financial analysis and determines the amount of excess revenues, called margins.

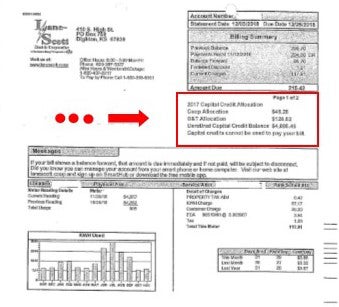

3. Each member receives a capital credit allocation of their share of the margins from the year. Every year typically in June, your allocation statement is printed on your bill.

4. When the cooperative's financial condition permits, the board of trustees will elect to retire, or pay out, a portion of capital credits. Retirements will occur for a specific year(s). If you paid for electricity during that year, you will get that year(s) capital credit allocation amount.

5. Lane-Scott will notify you of how and when you'll receive your capital credit retirement. Typically members can choose to be paid by check or a credit to your active Lane-Scott electric account.

Operating margins left over at the end of the year are allocated, or assigned, to a capital credit account in your name based on the amount of energy you purchased (patronage).

Your capital credit account, similar to a savings account, is the accumulation of margins which have been allocated to you each year based on your patronage.

Each year, the Board of Directors determines if capital credits will be retired by analyzing the financial health of the cooperative and will not authorize a retirement if Lane-Scott can't afford it.

Allocated capital credits appear as an entry on the permanent financial records and reflect your equity or ownership in Lane-Scott.

When capital credits are Retired for a certain year(s), either a check or credit to your active Lane-Scott account is issued to you if you had an allocation in the year the retirement is being issued for. Retirements are generally distributed 15-20 years after the year in which the margins were earned.

Capital Credits Explained

Questions & Answers

You should see an allocation notice printed on your bill annually, typically after the finances for the previous year have been audited, and provided the cooperative had margins and not a loss for the year.

Here is where the allocation is printed:

Your membership activates your capital credits account. Credits accumulate for anyone who purchased electricity during a year in which the utility earned margins.

No. Your electric bill is due now, whereas you may not be entitled to be paid your capital credits for many years.

Not necessarily. The board of trustees must authorize a retirement before you receive a payment. When considering a retirement, the Board analyzes the financial health of the cooperative and will not authorize a retirement if Lane-Scott can't afford it.

Capital credits are tax free if the property served by the Cooperative was used strictly as a residence. If the property was used for business purposes, members should consult with their tax advisor about potential tax liability.

What you should do if...

Keep the cooperative up-to-date with your current mailing address or name changes. If capital credits are retired, we will need to know where to send the check.

A representative of the deceased needs to contact our office and we will walk you through the next steps based on your individual situation.

Inform Lane-Scott of the situation. The capital credits will stay in the joint account until they are allocated, then allocated equally to the members on the account.

If one of the members on the joint account passes away, the allocation will automatically transfer to the other member on the account unless specified otherwise by the member passing. To do this, the member must have filled out a Request to Transfer Capital Credits Form.